I apologise for the late entry. Before I move on to the main topic, I shall discuss about this week where we saw a great rally for the for the week and a weakening oil price.

Sadly, the answer to the question above is no in my opinion.

To me, the behaviour of oil price as it approaches $150 mark is similar to the time when it marches towards the $100 mark. It is not a topping chart yet. But oil could still go lower, just that in the long run, I believe it will continue to move higher.

Is it a bottom?

We had a significant day where DJI closed below 11000. For the rest of the week, the market rallied on strong earning from the financials.

Again, my answer is no.

1. A bottom should always end with a panic sell out. Not necessary a market crash, but a strong top down punch to the market that to some extent brings the crowd back to believe that it is time for bargain hunting.

2. This is a weekly chart. It will actually be clearer if you take a look at the daily chart. But because of the time scale, the graph will not be visible on the post. Aug 16 marks the end of the July subprime correction. It was a day with a panic sell down and a late rally. Take note that the big swing was all in a day's work. The long leg you see was due to Aug 16.

3. Looking back at a more recent date - Jan 22. We have futures down some 400-500 points. Emergency rate cut saves the day, DJI closes down some 100 points in the end. Some may argue that March was actually the real bottom based on the chart above but the opening of Jan 22 was much lower than March lows. It was just that the market rallied too fast for its own good and it was punished with another selldown for few weeks after Jan 22.

4. Now if you look at this week, similar to both bottoms, we have a leg down (though it is actually a short leg). What concerns me was actually the open. Compare to the other two, this week opens stronger. Jul 15 was the day we penetrated through 11000. The low of the day was some 280 off Jul 14 close. We rallied back to just down 100 points. It was not actually a panic sell off. Well some people look at this thing called VIX - the fear indicator. I don't actually. I look at the numbers. The magnitude of the sell off was not great. What's 300 points? It's too little to be considered a sell off.

Performance to date

Horrible is the word that sums it all. I actually cover AMR, FNM, FRE on monday because they were too low for me to consider holding. But that was not enough apparently. My portfolio would have been close to even had I not leveraged it to some 250%. Added a lot more shorts using margin and the rest is history. But I'm still holding some of my short position. Too embarrassing to show it.

The Great US of A

Some background information

1. Total American Debt = $55 trillion (300-400% of GNP). You can find this easily actually.

2. Federal Debt = $9.5 trillion. They have a debt limit of $9.815 trillion.

3. Debt of America at Great Depression was 170% of GNP.

Honestly, how do you pay back $9.5 trillion? To understand how big a trillion is, you may look at it this way: it's the year 0, the beginning of the first millennium and you have a trillion dollars to spend at the rate of a million dollars a day. Keep spending till 2008, you still have 730 years to go, spending a million a day before you reach the end of your money pile. at Annual deficits add on to this number. We all know that US is an importer nation and the trade deficit just keeps adding on to it. Buffet explains trade deficit in an interesting manner. Obviously, US will not sell away their land. Maybe, they will print more money. If you draw an analogy between the US and the Weimar Republic, you will be pretty amazed.

Kondratieff Wave

1. It’s a long cycle of approximately 60 years. The first half of the cycle is a rising economy, followed by a plateau period, and the last quarter is a deflationary depression. I’ve divided the cycle into the four seasons of the year. Spring is the rebirth of the economy, summer is when it reaches its fruition, autumn is the feel-good period, and winter is when the economy dies. The onset of each of the seasons is indicated by either a bear market bottom or a bull market top in stock prices.

2. A theory on cycles. I'm not really an economics kind of person but I believe in cycles because human nature never changes. If our nature do not change, then history simply repeats itself. We will have a world war 3! Alright this is too far-fetched. I don't really mean that actually. But what I'm seeing now is a possible 2nd Great Depression.

3. The K-Wave theory is used to explain the rise and fall of superpowers (click the link for a table of past superpowers and their timeline). To some extent, if you look at I-ching (chinese philosophy), the first diagram "qian", coincides with the cycle theory and the rise and fall of a "dragon". Dragon is seen superior in Chinese Culture. In the "qian" diagram, they talk about the fall of the dragon as the final stage because of complacency. The dot.com bubble and the subprime crisis are two very good examples that exemplify men's complancency.

4. This is a table that I get from here. Another article about the K-wave theory. It is said that we are in the winter period of the cycle right now that begins in 2000. But stock market has been doing pretty well since. If year 2000 is the onset of the winter, then what we are seeing now is probably prolong of the winter due to credit expansion, resulting in a bear market rally.

5. After some 18 years of bull run, stocks began to look vulnerable with the speculation of dot.com bubble. When we did get that peak and the Nasdaq started to collapse, [former Fed chairman Alan] Greenspan panicked and brought interests down from 6% to 1%. He flooded the banking system with money, easy credit fostered another big boom in real estate, and stocks followed because so much money was available. The stock market loves low interest rates.

6. Sadly, in a bid to save one of the biggest equity bubble in history, Greenspan creates one of the biggest asset bubble in history which is now leading to the biggest credit crisis in history. Ouch. Smart of him to step down and throw everything to Ben Bernanke. Well you can read a book titled "Greenspan Bubbles". It is an anti-greenspan book to be honest.

Austrian School of Economics

There were many reasons for great depression. Debt was one of them. However, I was fascinated by the Austrian School. There is no means of avoiding the final collapse of a boom brought about by credit expansion. The question is only whether the crisis should come sooner as a result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system - Ludwig von Mises

The key word here is credit expansion. In the Austrian view it was this inflation of the money supply that led to an unsustainable boom in both asset prices (stocks and bonds) and capital goods.

From what I learn in my history textbook, it mentions that speculation drove the stock market to an unsustainable value and in the end the stock market collapsed. Depression is the aftermath of credit expansion.

Bringing the focus back on credit expansion. Credit expansion creates the appearance of a larger supply of capital and serves to reduce the market rate of interest below what it would otherwise be. To put in simple words, money appears out of nowhere. Do you get the hint I'm throwing to you?

Fuzzy Logic

It's time for some fuzzy logic. Let's talk about cycles. To understand what's Greenspan doing, I have to draw some graphs.

Alright my drawing isn't that good with windows paint. Ignore that please. Supposed we have a upward trending growth line. Our movement along this growth line will be something like a sinusoidal curve. Crest will represent excess capacity and trough will represent the return of pricing powers. We will experience downturns but these downturns are beneficial for the economy because they clear out the excess in the system for the greater good.

Alright my drawing isn't that good with windows paint. Ignore that please. Supposed we have a upward trending growth line. Our movement along this growth line will be something like a sinusoidal curve. Crest will represent excess capacity and trough will represent the return of pricing powers. We will experience downturns but these downturns are beneficial for the economy because they clear out the excess in the system for the greater good.But what the US or Greenspan has done is represented in the graph below.

By saving the economy when it approaches the trough, Greenspan is effectively keeping all the excess capacity in the economy which are not beneficial to the economy and will be cleared out sooner or later.

By saving the economy when it approaches the trough, Greenspan is effectively keeping all the excess capacity in the economy which are not beneficial to the economy and will be cleared out sooner or later.Forest Fires

I will use another analogy - Forest Fires. I learn this from Jim Rogers actually. Forest fires occur in nature as an act to clear out the excess. Dry leaves, dying woods are all burnt and decomposed, thus laying a good foundation for the remaining to grow and become more robust than before. However, if men were to put out forest fires everytime we see one, the excess accumulates. Sooner or later, the excess gets real huge and once a fire starts, men cannot put it out anymore. P.S: mailman added this actually.

The World Financial Crisis

Subprime was a virtually unknown word until Bear Sterns came out and announced the closure of two hedge funds. But to many experts, subprime mortgage was a time bomb that was ready to burst. I believe, for many years to come, a new financial term will trigger off the world's largest financial crisis ever, probably leading to the complete meltdown of the world banking system. Buffett calls them "weapons of mass destruction" (article on buffett) - Derivatives.

I believe that the trigger for the next depression is this.

Derivatives are financial instruments whose value changes in response to the changes in underlying variables. The main types of derivatives are futures, forwards, options, and swaps. The main use of derivatives is to reduce risk for one party. But this tool has turned the whole financial system into a huge gambling den.

A better understanding of Derivatives

The original article is here. I will do a summary actually. There are two types of derivatives, namely exchange traded and over-the-counter derivatives.

Exchange traded derivatives – these are futures or options contracts traded on an exchange. Like all derivatives, they are contracts whose prices are DERIVED from the price of a physical commodity, or a financial instrument such as a bond. The important thing is what party is the contracting party. With exchange traded derivatives, the party that is responsible for honouring the contract is the exchange itself.

Over-the-Counter (OTC) derivatives – these are contracts between professional counterparties themselves, such as two banks, or a bank and its corporate client, without an exchange in the middle.

Exchange traded derivatives are not the main concern in my opinion because there is no counter-partying risk since you are dealing with the exchange itself. OTC derivatives are the real time bomb. I copied a very good example from the article below."Let me give an example. Suppose Bank B buys an OTC derivative linked to oil prices from Bank A. And then later the same day, it decides to double its oil exposure, but this time it buys oil futures. To make the example fully congruent, let's assume that the futures bought by bank B were sold by bank A. A week later, the oil price rises, and the bank decides to take profits. It may then sell a same size oil derivative to bank C, and also sells the oil futures on the exchange. Again, we assume that bank C bought the oil futures.

So we have:

• Bank A's derivative – sold to bank B – later, resold to bank C

• Bank A's future..... – sold to bank B – later, resold to bank C

Now what accounting trail has been left from these two similar transactions? The OTC derivative will remain on bank B's books. In fact, it will have two transactions remaining on its books:

• Long : OTC oil derivative (with Bank A)

• Short: OTC oil derivative (with Bank C)

The netted out exposure to oil price risk may be zero, but there remains an oil-linked credit exposure which is now twice as big, because there is one on both the long and short side of the trade. Banks normally carry these risks until the maturity of the OTC derivatives contract, and the final settlement has been made."

The notional value of all the OTC derivatives exceed $500 trillion. I repeat $500,000,000,000,000. Fourteen big fat zeroes! But this number is probably exaggerated because there is some double counting. Some positions are winning, some are losing and if you net them out, you actually get the net profit/loss which shows a much lower net exposure. Nonetheless, the problem is still a very huge one. Supposed a big player in these derivatives go bust as Bear Sterns threatened to do so in March, that would trigger an early forced-settlement of all those still unexpired OTC derivatives trades. In a mass default, various unhelpful and disruptive actions would be taken by parties aiming to protect their positions, and/or benefit from the chaos.Speaking of Bear Sterns, they have an net exposure of $13 trillion in these derivatives. JP Morgan Chase had the largest exposure of all American Banks with $78 trillion. A cause for the astronomical value of the OTCs could be attributed to the legend "Alan Greenspan" for making money too easy to obtain. A good read here. Many pdfs over there, Winter warning volume 2 issue 3 is about OTC.

Of course no firms with large exposure in the derivatives market can fail, but how many can the Fed bail out? How do they go about doing it? Print more money and let the dollar plunge even more? The very reason why we have such high oil prices could be due to the weak dollar.

My point is...

It comes down to the rise and fall of a great nation. US has been a global leader for many years and somehow (fated?), they may fall in the future because of the trade deficits that continue to increase every single year and the misuse of credit. All these are signs of complacency. It is also a culture there isn't it? A credit nation that spends their future money. Even the war is on credit. Maybe there is some conspiracy theory in play, I don't know. There were some rumours about a new currency Amero. It is pretty much obvious that the dollar has to go as the world reserve currency. There is no way they can repay those debt in my opinion other than to print more money.

They prolong the "winter" period by creating another bubble and in the end, they will have to face the final catastrophe. The only way to negate credit expansion is obviously credit contraction which leads to deflation and a possible depression.

The OTC derivatives bubble could be the last and final bubble that dissolve the world banking system. Derivatives are not real assets after all, they are paper money. No one knows when will this bubble burst and where it will come from. But it will burst eventually because people get complacent and have abused it.

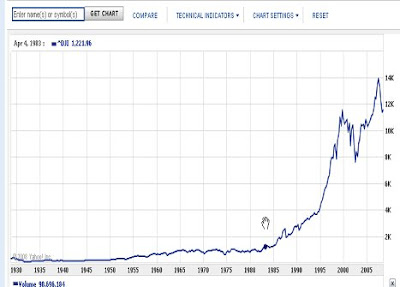

When I look back at this chart again, I just see an impending stock market doom. The fact that Buffett named the last centry as the "wonderful century" and that it would bring the Dow points to 2000000 if they were to repeat the last centry performance, shows that he has some worry about the perfomance of the market in the future. Buffett is a conservative man and usually he is very tactful with his words. I am just inferring from them.

If we wait for a complete head and shoulders to form, it could be 5-10 years time in the future. We could possibly see a bottom this year or early next year and go through a last bull run that probably last for another 3-5 years like the previous one did because of housing. Then we will see the final leg down to the stock market. How low can it go? During the great depression, the market lost 90% of its value but it shouldn't be that bad because companies are more global now. Nonetheless, I could see a period of time where depression happens and everyone will hate stocks. Many will criticize me, but this is my stand. Call me a natural bear or something, I believe we will see a 2nd great depression.

As to who will be the next superpower? India or China? I'm a chinese but I don't know if it will be China. There is a reason why the chinese has war all the time. Eunuch Zheng Ho had the biggest fleet of ships at one point of time that can only be matched by those in World War II. But they never conquer the world.

I will probably be doing a Part II. So do keep a look out for it. Lots of reading for this post but they are very important.

P.S: glad to see that I have visitors returning frequently on sunday and saturday to check for the update. Apologies for the late entry.

Depression is the aftermath of credit expansion

Ludwig von Mises

No comments:

Post a Comment