It is very important that I am only refering to stocks over here. Real estate, fixed deposit, bonds etc are all not included even though they are forms of investment as well. Commodities also belong to another category. Personally I love to invest in gold until it reaches $2000 right now.

I am definitely for trading rather than investing. Quite obvious isnt it (just read any post)? The no.1 reason why I support trading is because you are exposed to the short side of the market. Usually, the market moves up 1/3 of the time, down 1/3 of the time and sideways or flat for the last 1/3. By sticking to only buy-and-hold, you are only catching 1/3 of the market movement and you have to make sound decisions during this time period.

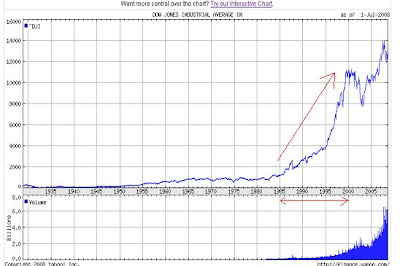

There is a super bull run from year 1982 to 2000. A bear market took place from 2000 to 2003 because of 9/11 attack and burst of dot-com bubble. This super bull run actually continues for another 4 years before it peaks out in October 2007. Anyone who invests in this period will tell you that buy-and-hold works. Well, this bull run produces a Warren Buffett. It works! I have to quote something from Buffett's letter to shareholders.

"During the 20th century, the Dow advanced from 66 to 11,497. This gain, though it appears huge, shrinks to 5.3% when compounded annually. An investor who owned the Dow throughout the century would also have received generous dividends for much of the period, but only about 2% or so in the final years. It was a wonderful century."

"Think now about this century. For investors to merely match that 5.3% market-value gain, the Dow--recently below 13,000--would need to close at about 2,000,000 on December 31, 2099. We are now eight years into this century, and we have racked up less than 2,000 of the 1,988,000 Dow points the market needed to travel in this hundred years to equal the 5.3% of the last."

2,000,000 Dow points!

Of course if you have wonderful foresight to spot certain good companies that can buck the overall trend of the market then I will throw in the white towel.

The thing is do you seriously expect the coming future to match the super bull run during the 1982-2000 period. What if after this bear market, the market moves into a lull period. How would you be doing as an investor before 1982?

Investing in emerging economies

China was a wonderful story for investors.

China was a crazy story. Almost everyone in china parks their money into the stock market. They even had a song for the stock market. The story was a quick one. In two years, it had gone up close to 500% and in approximately half a year, it was cut by half. Burst of a bubble? Why would you want to give up on the opportunity to short this market? Opportunity like this comes and goes all the time when people start to find new ideas or things to place their money in. Give yourself a chance to be in on the long side as well as the short side.

No comments:

Post a Comment