"We have had triple digit moves every day of the week: down 240 Monday, up 266 Tuesday, up 186 Wednesday, down 205 yesterday? What's it all mean? Nothing--Dow is unchanged for the week! " Quoted from Bob Pisani on cnbc.com. Of course, we have a minus 50 points on friday but its only 50! Anyway, this affirms the theory of sideway market trading before Fed's meeting. Something that we see all the time, even though this time it was pretty volatile.

Tues is Fed's meeting. They probably hold the rates again and I like to see the reaction of the market, especially oil prices which will be the trigger for stock prices next week.

Pretty disappointed that oil didnt form a three black crow. I mean if we were to see a three black crow i.e down in prices for this week as well, we could be seeing oil back to $100 soon. But it holds well above $120 for a star, well I hope to see a doji instead actually but a star is fine. I would be positive for oil next week. Nonetheless, oil shows some strength this week and the key is is how Iran responds to U.N. demands to end its nuclear program. Buy some oil futures, I could see it going back above $130.

As for stocks, we have earnings from some big names like AIG, P&G and Freddie Mac. Alright, Freddie Mac is already insolvent to most people so let's just ignore it. AIG is interesting. Financials seem to be doing decent these days. At least they are not beaten down badly.

In my opinion, go with the index. That's mean if you wish to be involved, buy some put options or futures or warrants in singapore case. You could probably get them on monday because of flat trading before Fed's meeting.

Deflation: Fed's Greatest FearDeflation was a hot topic in 2002. The Economist has a full article on it but I can't find that edition. Its the 10th Oct 2002 edition.

Deflation is the opposite of inflation. As of today, everyone seems to be talking about inflation with the super broad-based commodities price boom and crazy oil prices. Many have forgotten about deflation or rather the Fed has tried to avoid talking about deflation. Somehow, it seems that the Fed is more afraid of deflation than anything else.

Defining Deflation

1. In economic theory deflation is a general reduction in the level of prices, or of the prices of an entire kind of asset or commodity. Deflation should not be confused with temporarily falling prices; instead, it is a

sustained fall in general prices.

2. During deflation, while consumers can buy more with the same amount of money, they also have less access to money.

3. Consumers and producers who are in debt, such as mortgagors, suffer because as their (money) income drops, their (money) payments remain constant. Well, you borrow 100k to buy a house and the price of the house drops to 80k, but you have to repay the full 100k so you are having a net liability of 20k of a sudden.

4. Because the price of goods is falling, consumers have an incentive to delay purchases and consumption until prices fall further, which in turn reduces overall economic activity - contributing to the deflationary spiral.

5. In more recent economic thinking, deflation is related to risk, where the risk adjusted return of assets drops to negative, investors and buyers will hoard currency rather than invest it, even in the most solid of securities.

6. I consulted Mr.X and he gave me an interesting argument on point no. 4 using the culture of the people in the States. He said that the people there are so used to spending and have no savings at all. It is a very strong culture there and maybe to some extent, they won't delay their purchases, after all, they don't save for the rainy days.

My counter argument for that will be simply because the consumers have no money at all because of all the debts they have. This is a weak counter argument though. So Mr. X has raised an interesting point using culture, because while saving for the rainy days is more applicable to conservative Asian countries like Japan, it is not really the case for a country like U.S where people are so used to spend on credit.

7. Supposed consumers don't buy, it idles capacity, investment also falls, leading to further reductions in aggregate demand. This is the spiral effect of deflation.

8. Good deflation

For instance if there is a fixed money supply of 400 kg of gold in an economy that produces 200 widgets, then one widget will cost 2 kg of gold. However, next year if output is 400 widgets with the same money supply of 400 kg of gold the price of each widget will drop to 1 kg of gold. In this case the general fall in price was caused by increased productivity.

9. Bad deflation

The opposite of the above scenario has the same effect on prices, but a different cause. If there is a fixed money supply of 400 kg of gold in an economy that produces 200 widgets, then once again each widget will cost 2 kg of gold. However, if next year the money supply is cut in half to 200 kg of gold with the same output of 200 widgets, the price of each widget will now only be 1 kg of gold. When capital profits are dropping rapidly, there is no reason to invest gold, which breaks the savings identity, and thus the automatic tendency of the economy to move back to equilibrium.

10.

Also, Austrians (school of economics) believe that some entity being able to inflate or deflate a money supply is given a privilege, as all prices will not change both simultaneously and proportionally. Rather price changes will occur as a response to what seems to be changes in demand, although this is only in nominal terms. Those who can inflate or deflate the money supply (or those closest to this source) can take advantage of an otherwise unknown change in the money supply by making exchanges that appear sound in nominal terms, but actually confer more profitable exchange rates in real terms, once prices have adjusted to the change.

For example, if a widget costs 5g of gold today and there is 20g of gold in the money supply, if the central bank decreases the money supply to 10g, it can purchase sell its widgets for the formerly agreed upon price. Once the market finds less overall demand, however, prices will halve. While the central banks' money supply deflation was the cause of the price decrease, it received double the money for its widgets that they are now worth in real terms.

Well, there is a conspiracy theory that Fed is buying up lots of gold.

But Why Deflation?1.

The deflation of the Great Depression, as in 1836, did not begin because of any sudden rise or surplus in output. It occurred because there was an enormous contraction of credit, bankruptcies creating an environment where cash was in frantic demand, and the Federal Reserve did not adequately accommodate that demand, so banks toppled one-by-one (because they were unable to meet the sudden demand for cash.

The deflation of the Great Depression, as in 1836, did not begin because of any sudden rise or surplus in output. It occurred because there was an enormous contraction of credit, bankruptcies creating an environment where cash was in frantic demand, and the Federal Reserve did not adequately accommodate that demand, so banks toppled one-by-one (because they were unable to meet the sudden demand for cash.

Some economists (I don't know who) argue that the depression could have been prevented, had the Federal Reserve expanded the money supply. However, they failed to realise that the huge credit creation since world war I had already resulted an environment full of credit and further expansion of money supply would only prolong the deflationary period.

2. Let;s take an example that is closer to us in terms of time. Systemic reasons for deflation in Japan can be said to include

- Fallen asset prices. There was a rather large price bubble in both equities and real estate in Japan in the 1980s (peaking in late 1989). When assets decrease in value, the money supply shrinks, which is deflationary.

- Insolvent companies: Banks lent to companies and individuals that invested in real estate. When real estate values dropped, these loans could not be paid. The banks could try to collect on the collateral (land), but this wouldn't pay off the loan. Banks have delayed that decision, hoping asset prices would improve. These delays were allowed by national banking regulators. Some banks make even more loans to these companies that are used to service the debt they already have. This continuing process is known as maintaining an "unrealized loss", and until the assets are completely revalued and/or sold off (and the loss realized), it will continue to be a deflationary force in the economy.

- Fear of insolvent banks: Japanese people are afraid that banks will collapse so they prefer to buy gold or (United States or Japanese) Treasury bonds instead of saving their money in a bank account. This likewise means the money is not available for lending and therefore economic growth. This means that the savings rate depresses consumption, but does not appear in the economy in an efficient form to spur new investment.

Could you see the similarity between U.S and Japan? =)

3. The point is that deflation should - or so we thought - be easy to prevent: just print more money. And printing money is normally a pleasant experience for government. But if that's the case, Ben Bernanke will not be worrying so much. They are afraid of a liquidity trap similar to Japan.

The idea of a liquidity trap is something like this. It can be found in most common textbooks. Basically, there will come to a point where you can't increase aggregate demand anymore (interest rate close to 0). It's easy isn't it, which all the credit that the Fed has been creating, there is no doubt that a similar scenario from Japan will occur in the U.S.

4. At some point, capital betrayed into unproductive works has to either be repaid or written off. If either is inhibited by reflation or regulatory forbearance, then a cost is imposed on productive works, whether through inflation, higher interest, diversion of consumption, or taxation to socialise losses. Over time that cost ultimately hollows out the real productive economy leaving only bubble assets standing. Without a productive foundation, as reflation and forbearance reach their limits, those bubble assets must deflate.

This sums up the whole idea of debt-deflation theory.

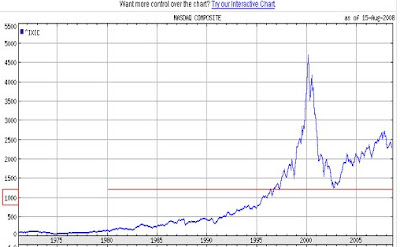

5. Quite a scary chart here. It is just a chart that I found recently to illustrate the debt to GDP ratio for Great Depression and now.

ConclusionThis links back to part I when I talk about a deflationary depression that will follow after a credit expansion. Holding money is what usually happens in a deflationary period. Some may argue that inflation is what we are really facing rather than deflation. But whether one is burnt to death (inflation) or frozen to death (deflation), the end result is the same isnt it?

A general fall in price is a very tricky issue to handle in terms of allocating your money and assets. No doubt, cash is king. But will people demand less oil and gold during times of deflation?

Not very sure about oil actually but let's look at gold. Well, I'm bullish for gold in long term.

The argument that I will give for buying gold during a deflationary period is that gold will be the form of money that people want to hold. I can't find a currency that may perform better than gold. This is on the assumption that people see gold as money. But if gold is just seen as a normal asset class, we could see gold going down with most commodities. Long Gold should it hit above $1000. I wish to see gold shows a strong support level at $1000.

You should hold currencies other than the dollar if you wish to hold cash. I suggest yuan and sing dollar. Not many reasons to back those currencies other than both have sound fundamentals.

I began to wonder why Jim Rogers talk about buying commodities in particularly agriculture. Apparently, he doesn't focus much on commodities like metals. In a way, buying only argiculture commodities make sense because in times of deflation, you still have to EAT! You do demand less metals, but you don't demand less food isn't it.

So, leaving argiculture aside, we could see a correction period for some commodities. I don't understand soft commodities so I shall leave them aside. I think it's good to short some metals actually. Oil is tricky. Unless I resolve the part on oil, I think it's better for you not to touch oil. I remember watching a video on Jim Rogers and he mentions about a supply side issue on oil despite low demand pushes oil prices up during the oil crisis in the 1970s. He says that supplies fall much faster than demand therefore we have oil prices going up and for the past thirty years, we have not found any new oil fields. Sounds interesting.

Nonetheless, we can go the traditional way of shorting the market. =)

All these macroeconomics stuffs are for long term purpose. It takes time for the debts to unwind and the deflationary spiral to kick in. Also don't forget, it takes time for the OTC derivatives bubble to bust.

Have a good read

here. But it is really long and dry. So read if you have the time.

Time For a Bounce

Time For a Bounce

The deflation of the Great Depression, as in 1836, did not begin because of any sudden rise or surplus in output. It occurred because there was an enormous contraction of credit, bankruptcies creating an environment where cash was in frantic demand, and the Federal Reserve did not adequately accommodate that demand, so banks toppled one-by-one (because they were unable to meet the sudden demand for cash.

The deflation of the Great Depression, as in 1836, did not begin because of any sudden rise or surplus in output. It occurred because there was an enormous contraction of credit, bankruptcies creating an environment where cash was in frantic demand, and the Federal Reserve did not adequately accommodate that demand, so banks toppled one-by-one (because they were unable to meet the sudden demand for cash.