I told you that if gold can't hold above $850, we will see it heading really low. The issue now is whether gold can hold at this level where we have seen a consolidation of price before. Pretty tricky isn't it? In my opinion, if you have listened to me and shorted gold, just hold it. If not, you may which to short gold at somewhere around $760-$770. You want to see the selloff continues next week. Hold until it hits $700. I think gold will head there because I can't see any stop to the dollar's strength. Hail King Dollar (at least for now)!

I told you that if gold can't hold above $850, we will see it heading really low. The issue now is whether gold can hold at this level where we have seen a consolidation of price before. Pretty tricky isn't it? In my opinion, if you have listened to me and shorted gold, just hold it. If not, you may which to short gold at somewhere around $760-$770. You want to see the selloff continues next week. Hold until it hits $700. I think gold will head there because I can't see any stop to the dollar's strength. Hail King Dollar (at least for now)!Bubble Bubble

You have to agree that Nasdaq and Shanghai Composite are two latest stock market bubbles that we have seen in this decade. If you disagree with me, please don't continue.

I was unsure about Shanghai a few weeks back because I don't really know what impact does Olympics have on the market. Apparently, a selloff begins on Olympics. How interesting is that?

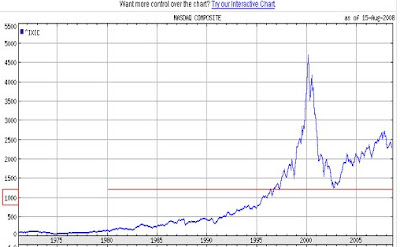

Anyway, to analyse a bubble, we must look at a bubble. There are many bubbles in history but we shall just take a look at the most recent one which is the Nasdaq Composite.

Similarities

1. Both are being talked about alot. Needless to say, even farmers in China are opening up accounts. They also have a song for the stock market.

2. Both shoot like a rocket. I feel that Nasdaq bubble began when it broke 1000. Topped at about 4600. For Shanghai, I am caught between 1700 and 2000. The top is slightly above 6000.

3. Both are bubbles.

Differences

1. One is called Nasdaq, the other is called Shanghai. Alright this is stupid. But I can't find any distinct difference between them to be honest.

Chart of Nasdaq

Chart of Shanghai

When will it bottom?

I feel that Shanghai at 2000 is a safe point for a bottom. If you notice, the big white candle was followed after Shanghai broke 2000. Afterwards, it was unstoppable. Probably the speed was its own undoing, but that's how bubbles work. Supposed we take 2000 as the bottom, then we will see another 20-25% decline in the market, before we start partying again. Whatever it is, short and hold!

Look out for a significant event that marks the bottom. Interest rate was down all the way to 1% and it marked the bottom of Nasdaq. Will we see a dejavu and another asset bubble in China? Time will tell. As of now, short and hold. You can also short HSI or STI along as well. Just hold you shorts while we wait for the bottom.

“Stock market bubbles don't grow out of thin air. They have a solid basis in reality, but reality as distorted by a misconception.”

George Soros

No comments:

Post a Comment